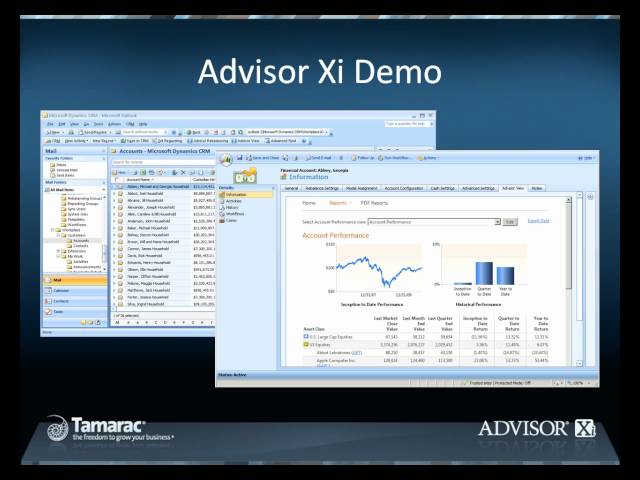

The financial technology landscape continually evolves, necessitating specialized tools for wealth management professionals. A crucial component within this ecosystem is client relationship management software tailored to the unique demands of financial advisors. Such systems are engineered to centralize client data, streamline communication, and enhance the overall service delivery, ultimately fostering stronger client relationships and operational efficiencies for advisory firms.

1. Core Functionality

The system provides a centralized repository for client information, encompassing contact details, financial goals, portfolio specifics, and communication history. This comprehensive view enables advisors to gain deep insights into their clients’ needs and preferences.

2. Integration Capabilities

A significant benefit of this solution is its seamless integration with other modules, such as portfolio reporting, rebalancing, and trading tools. This interconnectedness minimizes data silos, reduces manual entry, and ensures data consistency across various operational facets of an advisory practice.

3. Enhanced Client Engagement

By providing robust tools for managing interactions, scheduling follow-ups, and tracking client preferences, the platform empowers advisors to deliver highly personalized services. This capability is instrumental in building trust and loyalty among a firm’s client base.

4. Operational Efficiency

Workflows related to client onboarding, service requests, and compliance activities are significantly streamlined. Automation of routine tasks allows advisory staff to dedicate more time to value-added activities, directly contributing to increased productivity and scalability.

5. Tips for Maximizing Value

-

Thorough Data Migration Planning

Invest significant effort in planning the migration of existing client data to ensure accuracy, completeness, and proper categorization within the new system. A clean data import is foundational for effective utilization.

-

Comprehensive Staff Training

Provide all relevant staff members with extensive training on the platform’s features and functionalities. User adoption is critical for realizing the full benefits of the solution, so ongoing education and support are essential.

-

Workflow Customization

Leverage the system’s customization options to align it with the firm’s specific operational workflows and service models. Tailoring the platform ensures it supports unique business processes rather than imposing generic ones.

-

Utilize Reporting and Analytics

Regularly utilize the integrated reporting and analytics capabilities to gain actionable insights into client relationships, communication effectiveness, and overall business performance. This data-driven approach supports continuous improvement.

6. Frequently Asked Questions

What is the primary purpose of this wealth management solution?

The primary purpose is to centralize and manage all aspects of client relationships for financial advisory firms, including contact information, financial data, communication history, and service needs, thereby enhancing client engagement and operational efficiency.

How does this platform benefit financial advisors?

It benefits financial advisors by providing a holistic client view, streamlining administrative tasks, automating workflows, improving communication management, and integrating with other essential portfolio management tools, leading to more productive and personalized client service.

Is this system suitable for firms of all sizes?

Yes, the platform is designed with scalability in mind, making it suitable for a range of advisory firms, from smaller independent practices to larger enterprise operations, offering features that adapt to varying complexities and client volumes.

Does this solution integrate with other financial software?

The system is specifically engineered to integrate seamlessly with other components within its ecosystem, such as portfolio reporting, trading, and rebalancing modules, ensuring a unified and consistent data flow across different functions of an advisory firm.

What kind of support is available for users of this wealth management system?

Support typically includes comprehensive documentation, online resources, and direct customer service channels, designed to assist users with implementation, troubleshooting, and ongoing utilization of the platform’s features.

How does this CRM enhance client relationships?

The system enhances client relationships by enabling advisors to maintain detailed client profiles, track interactions, proactively manage communications, and personalize service offerings based on a thorough understanding of each client’s financial journey and preferences.

In conclusion, a robust client relationship management system is an indispensable asset for contemporary financial advisory practices. Its capacity to centralize information, foster seamless integrations, and elevate client engagement positions it as a foundational technology for firms aiming to optimize operations and deliver superior service in the competitive wealth management industry. The strategic implementation of such a solution empowers advisors to focus more intently on client needs, ultimately driving growth and sustained client satisfaction.

Youtube Video: